重点推荐:5人制标准球门 7人制标准球门 11人制标准球门

更多>

公司介绍

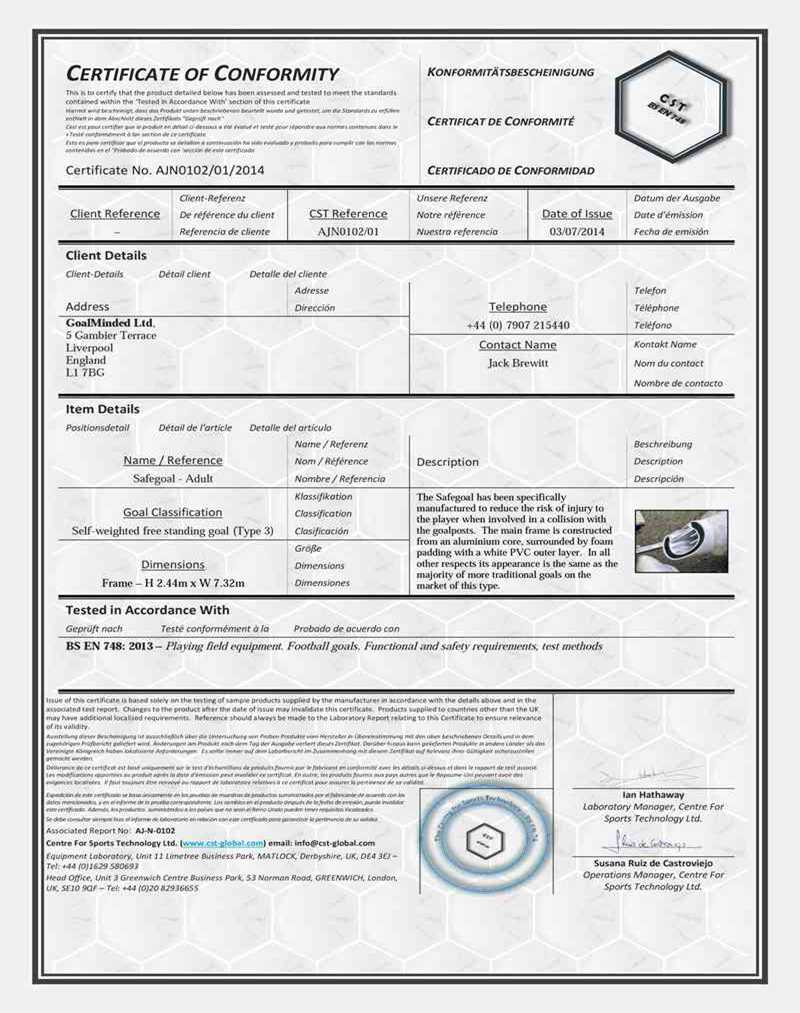

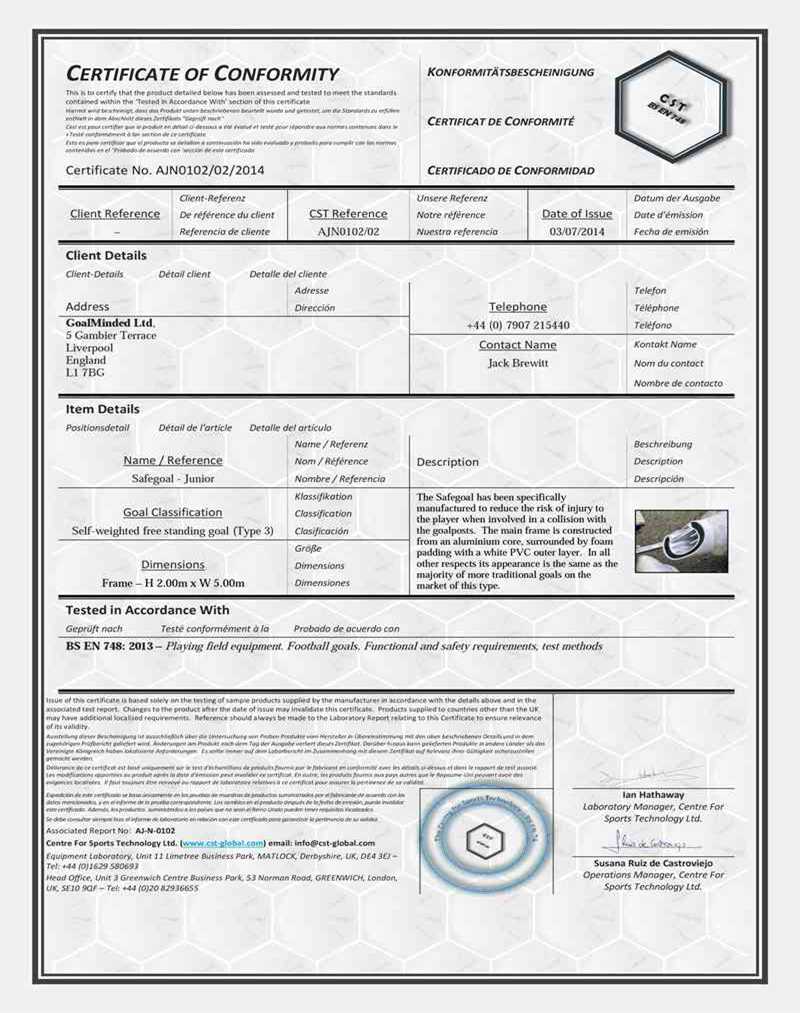

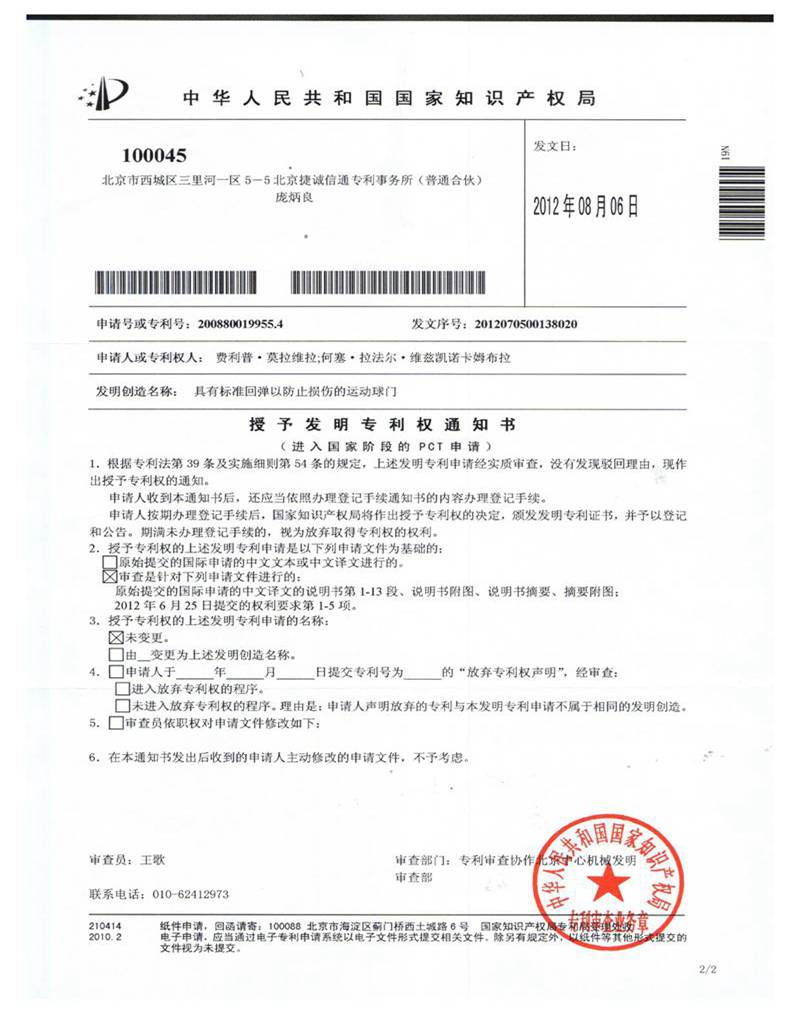

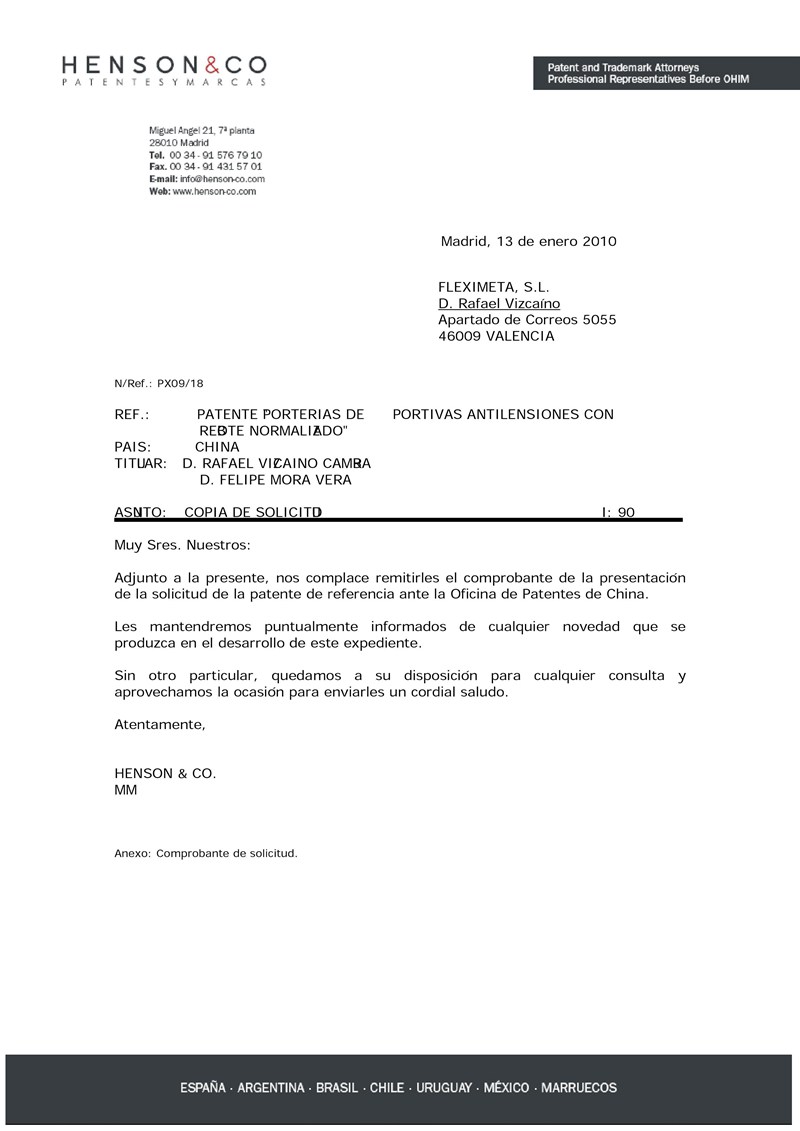

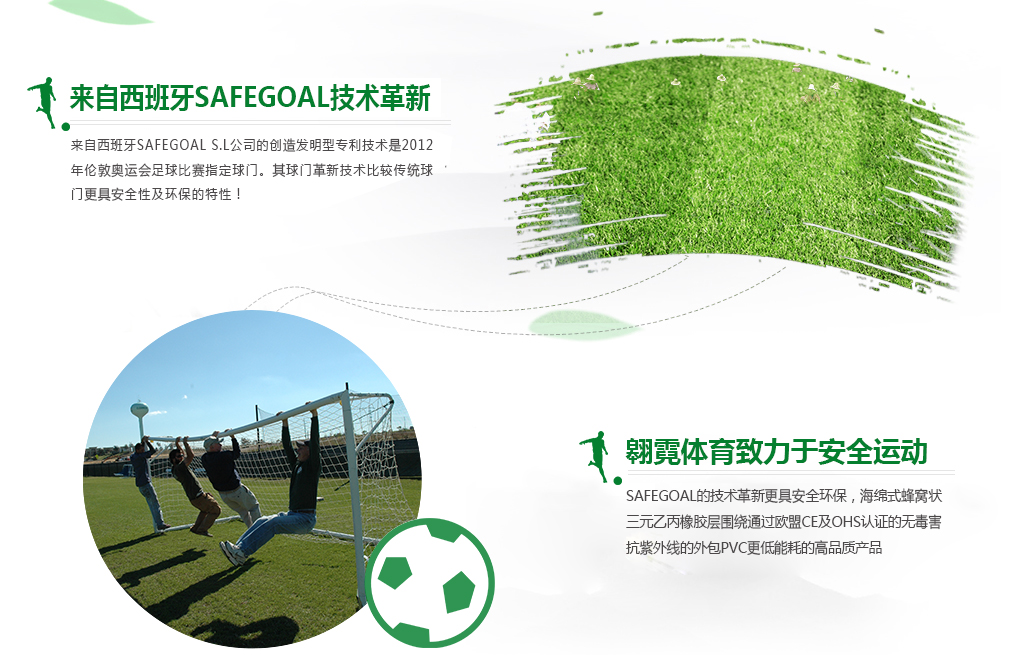

【BET足球】中国有限公司是一家从事体育赛事活动策划;体育用品、运动及健身器材生产和销售的专业公司。 2015年公司和西班牙Safegoal S.L公司达成战略合作,将SAFEGOAL安全球门引入中国。 目前,我们国内使用的球门大多数都是铁制和铝制的,都存在很严重的安全隐患,如果和球门发生碰撞,球员很容易受伤,造成伤残,严重的甚至危及生命。所以欧洲已经率先对球门进行更新换代,淘汰了铁制球门。 西班牙SAFEGOAL球门,是一款来自绿茵场上的技术革新产品。它采用在铝芯外包裹海绵式蜂窝状材料,外层覆盖PVC表皮,三者的结合使SAFEGOAL球门既能有效地减弱运动者与其碰撞时所承受的冲击力,为运动者提供有效的安全保护;又具有与传统球门相同的反弹力。 西班牙SAFEGOAL球门已经通过欧盟等专业机构认证并在欧洲各国和中...

【BET足球】中国有限公司是一家从事体育赛事活动策划;体育用品、运动及健身器材生产和销售的专业公司。 2015年公司和西班牙Safegoal S.L公司达成战略合作,将SAFEGOAL安全球门引入中国。 目前,我们国内使用的球门大多数都是铁制和铝制的,都存在很严重的安全隐患,如果和球门发生碰撞,球员很容易受伤,造成伤残,严重的甚至危及生命。所以欧洲已经率先对球门进行更新换代,淘汰了铁制球门。 西班牙SAFEGOAL球门,是一款来自绿茵场上的技术革新产品。它采用在铝芯外包裹海绵式蜂窝状材料,外层覆盖PVC表皮,三者的结合使SAFEGOAL球门既能有效地减弱运动者与其碰撞时所承受的冲击力,为运动者提供有效的安全保护;又具有与传统球门相同的反弹力。 西班牙SAFEGOAL球门已经通过欧盟等专业机构认证并在欧洲各国和中...更多>

公司动态

- 牵手足球明星,步入绿茵场,共唱国歌,亮相荧屏,相信是不少孩童的梦想,盘锦中支帮助不少孩子圆了这个梦。 2015...

- 在足球这类充满激烈碰撞的竞技体育运动中,保护运动员的安全显得至关重要。为了寻找比赛安全优化并防止冲击造成大量伤害的...

- 揪心!球门突然倒下,砸中三名小学生 当时正在上体育课,其中一个孩子不幸身亡,另两个受伤 3月30日上午,宿迁市...

更多>

常见问题

- 揪心!球门突然倒下,砸中三名小学生 当时正在上体育课,其中一个孩子不幸身亡,另两个受伤 3月30日上午,宿迁市...

- 24岁的研究生广伟在学校锻炼时,被倒下的简易足球门砸中身亡。近日,经过乌市中级人民法院调解,新疆财经大学赔偿死者父...

- 晋城市阳城县凤城镇西关村村民反映,一位名叫王政的16岁少年8月15日晚在该村足球场观看歌咏比赛时,不幸被翻倒的足球...